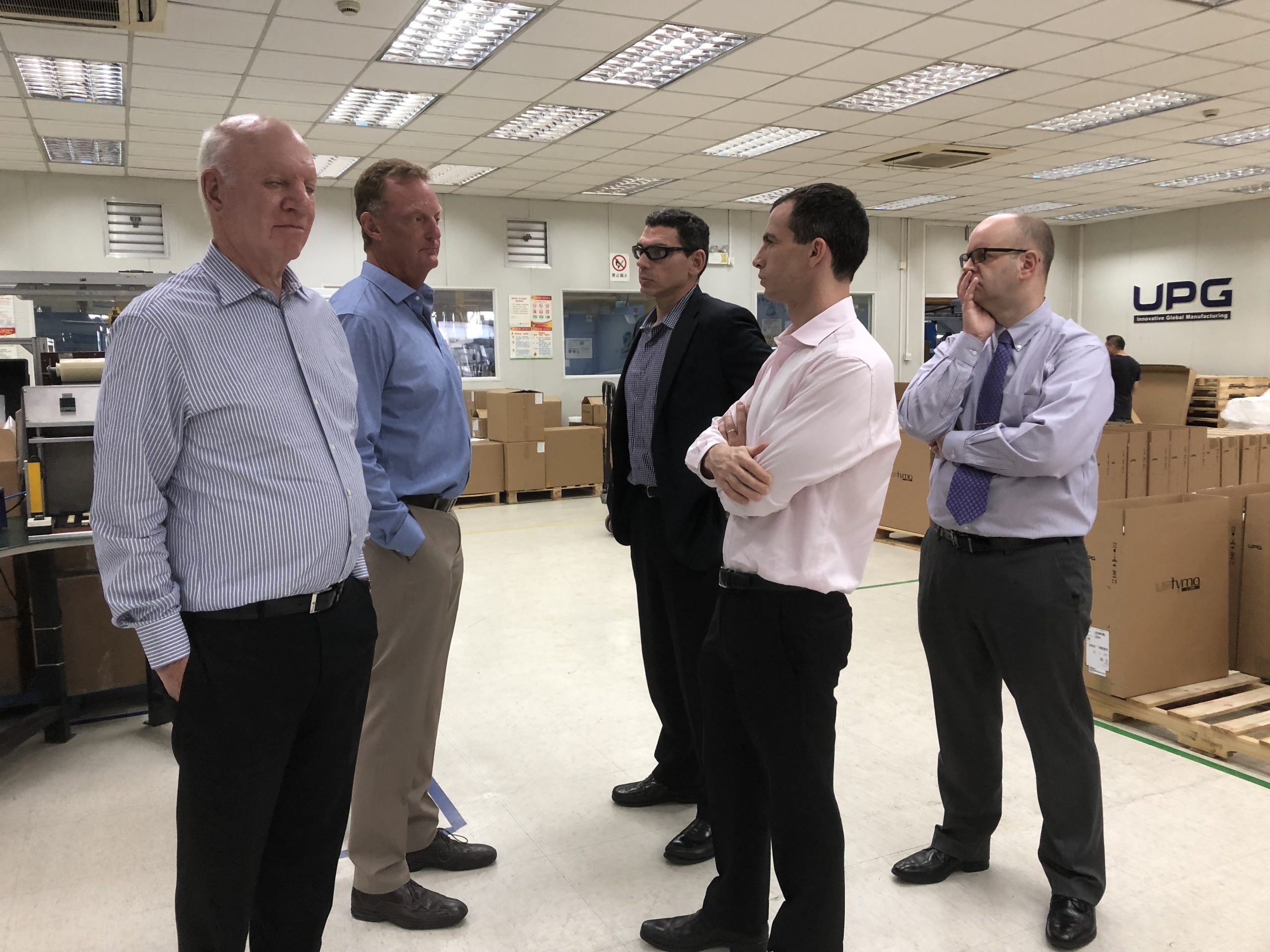

出任UPG后的首次董事会【First board meeting in China after joining UPG】

作者: 2018年10月29日

经过5个多月的紧张工作,我出席了在苏州召开的UPG董事会。会议中,我向大家展示我将如何带领团队在5年未有新客户的情况下开发中国市场。虽然UPG 有着良好的客户基础,但仍需高品质的客户群和其他的资源才能进一步的渗透到更具价值的市场。

After 5 months of intensive work, I joined in board meeting in Suzhou to show how can we develop Chinese market after no new customer more than 5 years in UPG. Even though UPG has a good foundation of customers. It has high customer concentration and need additional resources to penetrate valued market.

通过苏州领导团队的努力,我们在短时间内取得的显著成绩,其中包括短时间内成功聚集100多名来自汽车、医疗等行业的客户参会;2个月内接洽了高品质目标客户24家;以及在1个月内拿到9个RFQ。这些喜人成绩无不鼓舞着我们每一位董事。

With the leadership of Suzhou team, they are inspired by what we have done and we will achieve, including +100 customers from automotive, medical and other industries gathering in a short time, +24 new targeted and valued customers approached within 2 months, 9 RFQs under negotiation within one month.

董事Neil告诉我,UPG正翻开新的篇章。此前,我们不知道如何塑造UPG未来,但现在通过你对市场的解释以及探索,我们确信你知道如何引领UPG 的未来,也因此我们对未来的前景与项目充满了希望与期待。当然,实现这些目标的关键需要销售、市场、技术、供应链、运营和财务的通力合作。从管理团队的升级、到与市场的重新对接,我们也将从中的建立起信心并构建好基础。

Neil told us we are turning the pages. Before we don’t know how to shape the future. Now with your explanation and exploration to market, we are confident that you know what you are doing, we have more than hope for all the prospective and projects. However joined effort from sales, marketing, technical, supplier chain, operational and finance would be key to make all the things happen. From the management team upgrade, reconnect with market, we need go through the process to rebuild the confidence, make the basic things.

UPG是Turnsprire旗下收购的公司之一。我的任务是协同CEO Maurice致力于增加UPG 在投资市场盈利倍数。

UPG is one of company acquired by Turnsprire. My mission is to work with CEO Maurice to make UPG increase the multiples on the investment market.

Turnspire CapitalPartners是一家私人投资公司,专注于收购高质业务的企业。我们将实践操作经验运用于这些在战略、运营或财务上处于转折点需要进行升级的公司。我们寻求通过与志同道合的运营管理人员合作从而创造价值,以推动在可控制成本、利润率和现金流等方面的可持续改善。

Turnspire Capital Partners is a private investment firm focused on acquiring high-quality businesses that have reached strategic, operational or financial inflection points and stand to benefit from our hands-on, operationally focused approach. We seek to create value by working with like-minded operating executives to drive sustainable improvements in controllable costs, margins and cash flow.

Turnspire的投资哲学不是仅仅用一般投资常用的财务杠杆,而是基于运营改善的方式来创造价值。Turnspire力求将旗下的每个公司打造成各自领域的一流企业,继而通过重组的举措或战略性收购来促进业务进一步发展。

Turnspire’s investment philosophy is predicated on creating value through operational improvements rather than financial leverage. We strive to make each of our companies best-in-class in their respective industry niche, and then to grow the businesses through organic initiatives or strategic acquisitions.

董事会后,董事长称:

After the board meeting, board chairman said,

“We greatly appreciate your hospitality, your time, your thoughts and all your work to make UPG great. We thoroughly enjoyed seeing and hearing about the progress all of you have made in the facility, with the UPG Suzhou team, and with the customers. We are excited about what you can do and look forward to great things!”

我非常荣幸能与Turnspire 的董事们和CEO Maurice 一起共事,这与我来说也是极好的经历。

It is great experience to work withTurnspire’s leaders and CEO Maurice.